If you’re familiar with the Entrepreneurial Operating System (EOS), you know it’s a popular management system used by small businesses. We’ve used it internally at SmartBooks since 2012, and in our experience working with small businesses, there’s one main issue that seems to trip up organizations: Filling the EOS Finance seat.

What Is the EOS Finance Seat?

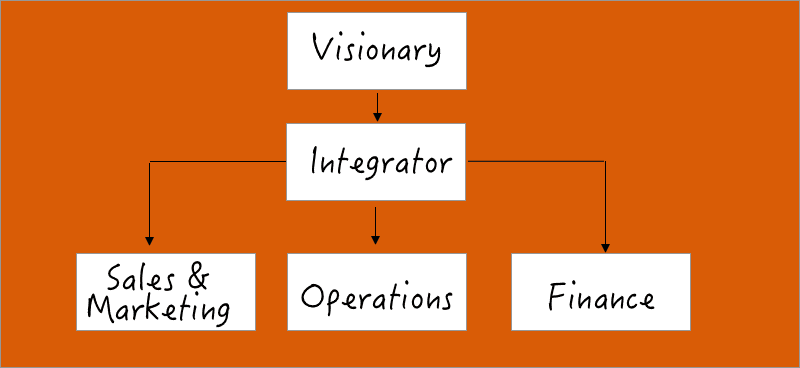

EOS calls its version of the company org chart the “Accountability Chart.” In EOS, each major function has a seat, with one person assigned to each role. These seats typically include roles like Visionary, Integrator, Marketing and Sales, Operations, and Finance. Some are easy to fill, such as the Visionary seat, which is almost always occupied by the company founder. But others, like the EOS Finance seat, are a bit more challenging.

While many founders are great salespeople or technical experts, oftentimes they lack expertise in accounting. Likewise, it’s difficult to find new hires to fill the role, because the Finance function in many small businesses isn’t a full-time job. Filling 40 hours per week will mean doing other tasks on top of senior financial management work: bookkeeping, accounting, IT, office management, HR, and legal. Nevertheless, filling the Finance seat is a crucial task that every small business needs to address at some point in its growth.

What Do You Need from Your Finance Expert?

Filling the Finance seat means defining your company’s desired financial stack and targeting where you need help. At a minimum, the finance stack includes:

- Bookkeeping

- Basic accounting (closing books accurately each month)

- Financial reporting

- Planning and analysis

- Financial decision-making

It’s a lot for one person to handle, and in our experience, it’s best to split the work this way:

- The business owner holds the Finance Seat to spearhead management and decision-making

- Outsource bookkeeping and accounting functions.

Maintain Control Over Finance

According to financial gurus like Warren Buffet and William Thorndike’s research, the most important job of a CEO is capital allocation. This means deciding where to spend and invest money. This crucial function can’t be outsourced, and it’s a great example of the oversight required of founders. Founders have the most on the line financially as well as the biggest investment in key risk/reward decisions.

There are alternatives, but these solutions aren’t ideal:

- Filling the seat with junior staff: Having your office manager or bookkeeper, for example, fill the seat tends to create problems. By introducing a junior employee to your leadership team, you’ll end up with a mismatch of skills and performance level across that team.

- Owner-performed: The owner could do everything, but most business owners lack the time and skills to manage financial tasks on top of their other duties.

- Part-time consultants: External consultants can handle some tasks, but the limitations of these relationships mean the part-time employee won’t be as involved or as engaged as a full-time team member.

Balance Delegation and Ownership

Business owners can’t delegate ownership, but they also can’t do everything themselves. Learning which tasks and decision-making roles can be delegated is a delicate balance, but it’s certainly possible with the right plan. Look at your organization’s structure and determine which functions need your supervision, and which can be handed-off.

If you want to hear more about our thoughts on the Finance Seat, check out this video from our founder and CEO, Cal Wilder.