Financial Considerations For Business Reopening During COVID19

After being largely closed since March, businesses are in varying stages of reopening across the country. Given uncertainties around the pace of reopening and the return to normal economic activity, financial planning is more important than ever.

Complicating matters, many businesses have burned through cash reserves trying to remain in business during the extended shutdown since March.

Payroll Protection Program (PPP) funding has covered a significant amount of operating expenses for many businesses. However, other businesses either did not qualify for PPP funding or had large operating expenses that were not eligible for reimbursement under the PPP Program. Additionally, PPP funding will be exhausted by most businesses who did receive funding in the next several weeks, if it has not already been exhausted.

The bottom line is that businesses must largely finance reopening operations on their own, with less of a cash cushion to fall back on now, and with less margin for error.

Here we lay out an approach to modeling and managing through the reopening process.

Forecast Sales

The first thing to do is to project expected sales. Sales volume defines the level of expenses that can be incurred while remaining profitable or at least break-even. There might be strategic considerations to the pace and extent of your reopening, if your competition opens more fully and faster than you. However, small businesses cannot afford to operate at a loss for long.

Sales forecasts may be impacted by a number of factors including:

- Operating capacity. For example, if your business is a restaurant or retail store and can only operate at 50% capacity, then its revenue potential is halved.

- Current market demand. For example, maybe there is pent-up demand for hair salons while demand for travel-related services remains depressed.

- Available product to sell. For example, certain supply chains remain disrupted and you want to be sure you have access to additional inventory when sales ramp up.

Assess Expense Structure

Assess your variable and fixed direct costs of producing and delivering the goods and services you sell. An example of a variable cost would be a third-party product that is resold. If there is no sale, there is no such cost incurred. Another variable cost would be hourly employees who can flex their hours up and down based on need. An example of a fixed cost would be a salaried manager who is paid regardless of sales volume. Certain fixed costs are step costs, meaning they incur a significant “step up” in fixed costs when incurred. For example, hiring a salaried employee is a step cost as it significantly increases fixed costs.

In an uncertain revenue environment, it may be prudent to rely on variable costs until it becomes clear what actual sales volumes will be. Then fixed costs can be added, with caution around incurring incremental step costs.

Create Scenario Plans

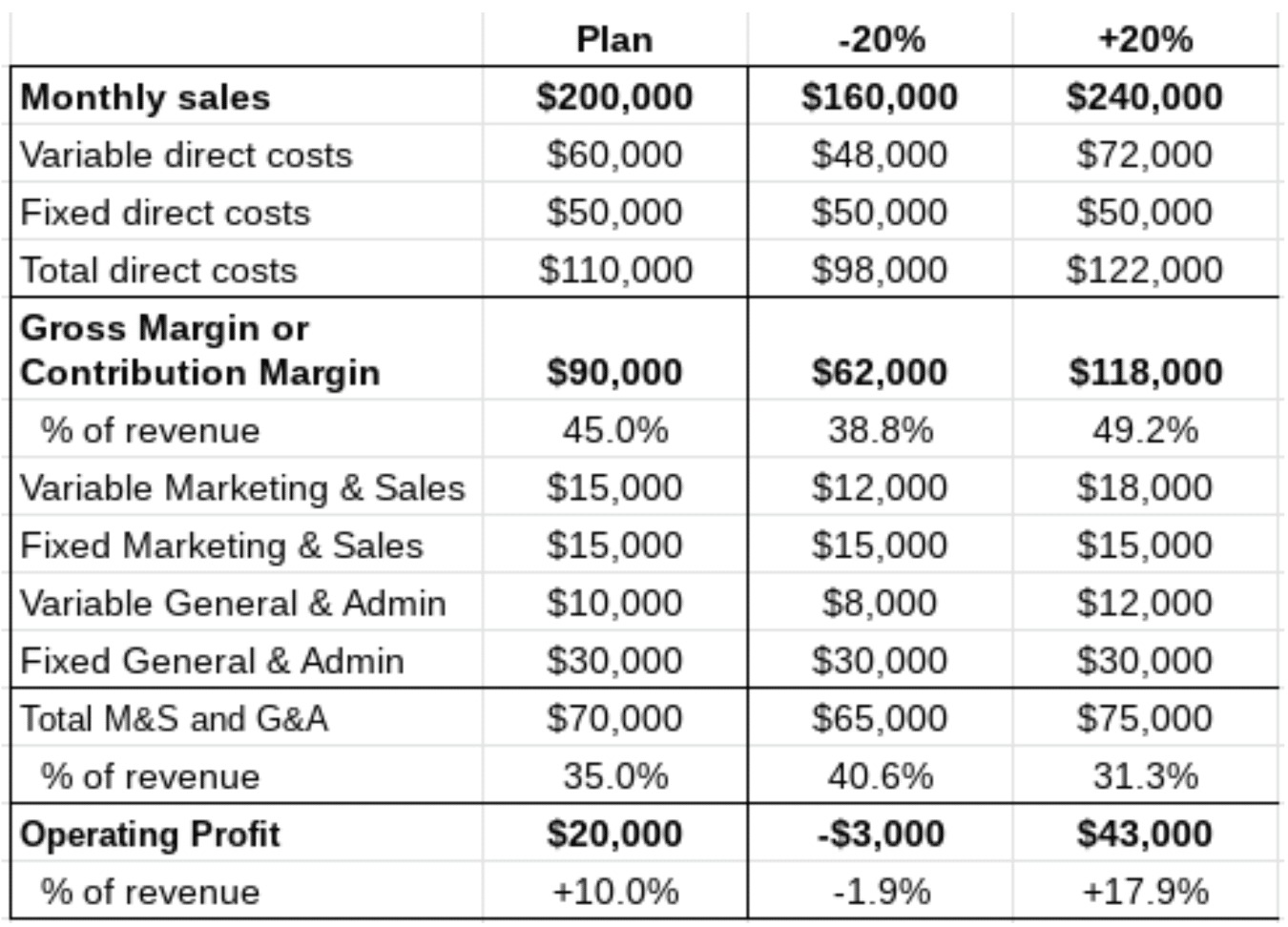

Given the level of uncertainty in the economy, multiple scenarios and contingency plans should be created. Starting with your sales forecast, create scenarios in which sales are worse than, the same, and better than your forecast. Determine the expenses you plan to incur in each sales scenario. Determine when you are willing to incur fixed costs and step-ups in fixed costs.

Be sure to factor in the cost of safety compliance and personal protective equipment. Operating during COVID will be more expensive than before COVID.

Compile all this data into a set of full P&L scenarios. This will paint a picture of your profitability at varying levels of sales. Here is an example of full P&L scenarios with revenue +/- 20% compared to the current forecast plan.

Also consider a contingency plan if business closure is re-ordered, as has been ordered in certain states with escalating COVID19 case counts.

Assess Working Capital Needs

Working capital refers to the cash that is consumed in operating the business such as paying for inventory before its sale, waiting for customers to pay their accounts receivable, or paying for services in advance of receiving them. This all impacts your cash flow. Even if a business reports a profit on its P&L, it may still have negative cash flow. If cash reserves and lines of credit are low, work to improve your cash cycle. The cash cycle is the time between when you pay to provide a good or service to customers and pay your associated operating expenses, and when customers pay you. Consider customer payment terms. Consider customer creditworthiness, as customers are facing their own COVID financial distress. Consider negotiating extended vendor terms. When cash is tight, the cash cycle is king.

Consider Debt Financing For Growth

Interest rates are incredibly low, for borrowers who qualify. If your business is fortunate to be in a position to grow and expand, financing that growth with debt is a financially attractive option. Beware the temptation, however, to borrow to finance current money-losing operations. Just because debt capital is available does not mean it should be borrowed. Debt must be repaid out of future profits or personal assets.

Summary

These concepts are good general business practices to work into management routines. However, they are more important than ever now given that we’re in one of the most dynamic economic environments in decades.

Need some additional guidance?

We invite you to schedule a Free Consultation with our team of professionals who are here to help you navigate the PPP and other loan programs.