What Is a Finance Stack?

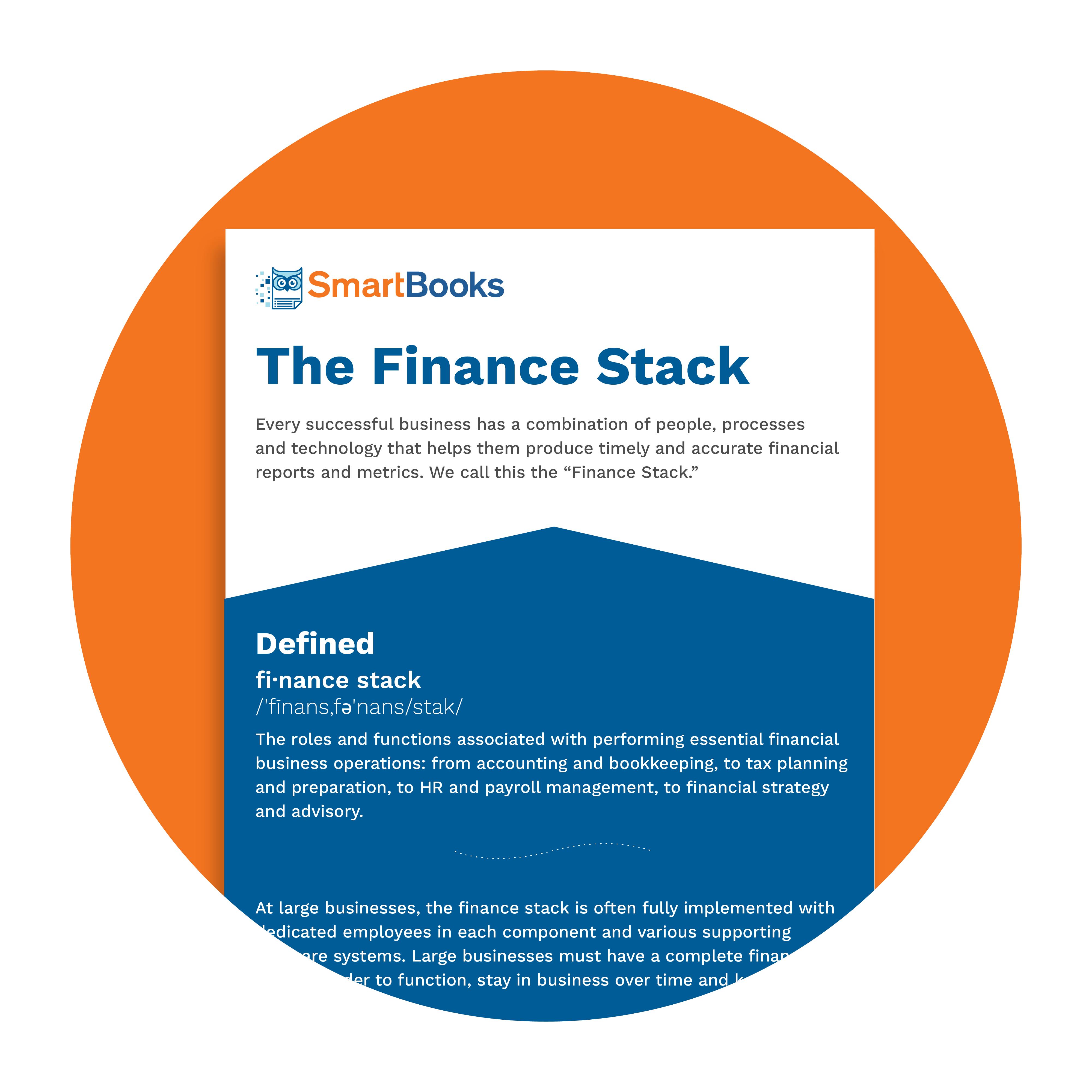

Every successful business, whether it’s a startup or a growing enterprise, relies on a strong finance stack infographic. This stack includes the layers of financial management that support profitability and control. It ranges from day-to-day bookkeeping to budgeting, forecasting, and strategic decision-making.

Each level comes with clear responsibilities. When those layers align properly, they drive efficiency, reduce risk, and help the business grow.

It’s More Than Just Tools

Most people think the finance stack is all about software. While tools like QuickBooks and dashboards matter, they aren’t enough on their own.

True financial clarity requires more than great software. You also need experienced people and efficient processes. These help you manage, interpret, and act on the numbers in real time.

Are You Feeling the Gaps?

If you’re struggling to scale or feel unsure about cash flow, margins, or decision-making, your finance stack might be the issue.

Maybe you don’t have a controller or financial analyst in place. Maybe your reporting is late or unreliable. Or maybe you’re depending on one overworked person to handle everything, and they can’t be strategic.

Time for a Finance Stack Check

It’s important to step back and examine your current finance stack. Ask yourself:

- Are your systems aligned with your growth stage?

- Are you receiving forward-looking insights or just after-the-fact reports?

- Do you have the right mix of people, tools, and workflows?

If the answer is no, it’s time to act.

The Advantage of a Well-Built Stack

When you view your finance function as a system, it becomes easier to identify what’s missing. You can fix inefficiencies, fill gaps, and build something scalable.

That structure gives you clarity. It also gives you peace of mind and an edge over the competition.

Download our infographic to see how a well-designed finance stack is structured and how you can strengthen yours today.