Modeling and Managing the Financial Impact of COVID-19 on Your Business

Due to the COVID-19 pandemic, businesses are grappling with a high degree of uncertainty and some fear about their revenue, profit, and cash flow for the next several months or longer. While a small segment of businesses will benefit from an increase in demand for their goods or services, most businesses face a decline in sales.

This white paper focuses on modeling and managing through potentially large sales declines until economic activity recovers to a normal level. First we’ll focus on underlying operating profitability, then look at cash flow management.

Click here to download a PDF copy of this white paper.

P&L Scenario Analysis

1. Assess Sales Scenarios

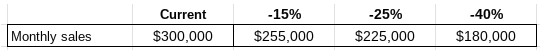

First, assess revenue streams overall and the risk they decline. Also assess individual customers and the risk they curtail purchases. Forecast a few realistic scenarios ranging from what would be a modest decline for you in sales from current volumes to what would be a large decline from current volumes. These forecasts will vary significantly by industry and by companies within the same industry. You might end up with the following scenarios:

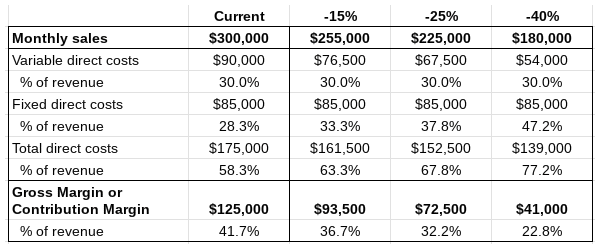

2. Assess Direct Cost Structure

Second, assess your variable and fixed direct costs of producing and delivering the goods and services you sell. An example of a variable cost would be a third party product that is resold. If there is no sale, there is no such cost incurred. While on paper you don’t need to cut variable costs, in reality you do need to make sure for example the company does not reorder inventory which is not needed. An example of a fixed cost would be a salaried project engineer who provides services to customers. If there are no projects to deliver, the salary is still paid.

Project those variable and fixed costs over your revenue forecast scenarios. You might end up with the following direct cost and margin scenarios:

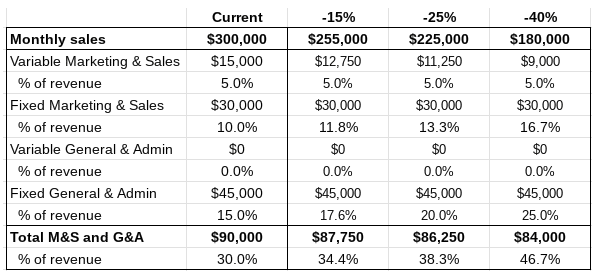

3. Assess SG&A Cost Structure

Third, look at your Marketing & Sales and General & Administrative expenses, and separate the fixed from the variable costs. Project those variable and fixed costs over your revenue forecast scenarios. You may end up with the following SG&A cost scenarios:

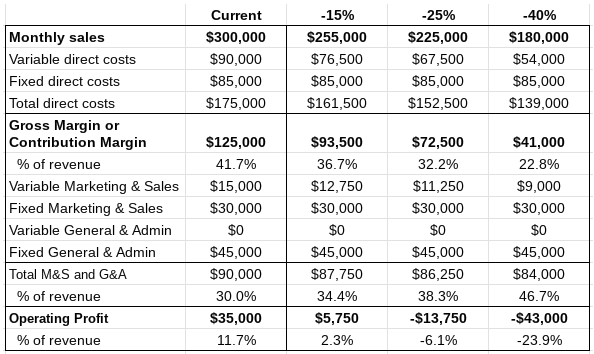

4. Compile Full P&L Scenarios

Fourth, compile all this data into a set of full P&L scenarios. This will paint the picture of your profitability at varying levels of sales decline. There will be a point at which the business becomes unprofitable, in this case around a 17%-18% sales decline.

5. Plan and Prioritize Cost Cuts

Depending on how dire your forecasted scenarios are, you may or may not need to enact cost cuts right away. Even if you have a healthy cash reserve and do not expect much of a decline in sales, it is worth spending some time creating a contingency plan for cost cutting in case sales decline more than you expect.

Because variable costs naturally drop when sales drop, cost cutting efforts focus mostly on reducing fixed costs. Certainly chisel away at variable costs the best you can to reduce variable costs as a percentage of revenue. However, if a business shrinks significantly in size it is inevitable that fixed costs will be too high as a percentage of revenue. Current fixed costs were built up to support the company at its current volume levels, not a company producing significantly smaller volume levels.

Ultimately cost cutting is a matter of deciding which costs can be cut with the minimum impact on serving existing customers, “keeping the lights on” from an administrative perspective, and preserving the ability to bring in new customers now and in the future when economic activity picks up.

The largest fixed cost in most businesses is payroll. Eliminating salaries is a painful decision though often necessary. Sometimes there are alternatives to permanently terminating employees, such as temporarily moving certain positions to part-time or an across-the-board salary reduction or a furlough. Because cutting good employees has longer term consequences, many businesses take a hard look at other non-payroll costs and see what other variable or fixed costs can be cut before eliminating employees.

How aggressively to cut costs is largely a function of:

- How profitable the business is currently, and how far sales need to decline in order to lose money

- How much cash reserve the business has

- How confident the business is in its sales forecasts and resulting P&L forecasts

- How much tolerance ownership has for losing money, including its ability to forego pay for some period of time

As you make cost cutting decisions, flow those decisions through your P&L scenarios nothing the reason for changes to different expense lines.

Cash Flow Management

Once you have modeled your underlying P&L, then you can model expected operating cash flow from those scenarios. Translating an income statement into a cash flow forecast is a whole separate white paper topic. For our purposes we’ll assume in general that operating cash flow over time approximates reported operating profit on the P&L.

Ironically when sales are contracting, cash flow can be positive as accounts receivable are being collected at a faster rate than new sales are being invoiced. This cash influx is a one-time event. Once older outstanding receivables are collected, then you’re left collecting on a smaller volume of more recent receivables. However, this positive cash flow only results if cash expenses are less than cash receipts. So those cost cutting moves defined in your scenarios still need to happen even if it looks like cash is rolling in.

Cash Flow Vigilance

In dire economic times, cash flow vigilance is more important than ever. Here are a few basic cash flow practices:

- Identify how much cash you have on hand relative to monthly operating expenses. There is a level at which you can’t go below and still be able to make payroll. That may be around ½ of one month’s operating expenses. If you approach that level, rapid cost cutting and/or borrowing is critical. You may need to monitor this daily, at a minimum once per week.

- Be extra diligent on collecting accounts receivable and identifying bad debt risk before those customers get into you for too much, especially if you incur third party cost of goods sold that you must pay out even if your customer does not pay you. In the best of times small businesses don’t have much insight into the financial condition of their customers. In the midst of a pandemic, assume any customer could be in financial distress and unable or unwilling to pay you. Naturally you want to be accommodating to good customers, but you also need to protect your own business and its ability to pay its employees and stay in business.

- Negotiate extended payment terms with your largest creditors. If you can get an extra 15 or 30 days to pay a large vendor, that gives you an extra 15-30 days to collect from your customers.

- Conserve cash and approve only essential expenses.

Nurture or Establish Bank Lending Relationships

As the old saying goes, the best time to borrow money is when you don’t need it. While it might be a little bit late for that now, it is the time to review your borrowing capacity in the event you need or want to borrow money to maintain your business or to take advantage of an opportunity that may arise in the current market disruption.

If you don’t have a line of credit, now is the time to put one in place. It will be fastest and easiest to work with your current bank than to establish a brand new banking relationship. Especially now with banks curtailing in-person office hours and getting a lot of calls from existing customers. If you already have a line of credit, speak with your bank about increasing your borrowing capacity. If you have drawn down a large amount on your line of credit and don’t expect to be able to repay it anytime soon, consider trying to convert it into a term loan which locks in a low fixed interest rate for a number of years and is not subject to annual renewal.

The U.S. Small Business Association (SBA) is also ramping up special lending programs to help small businesses cope with the impact of COVID-19. New information is being released days on the SBA website. Many banks loan to small businesses using SBA programs, so don’t be surprised if your bank mentions utilizing the SBA for a term loan.

Understand Cost of Capital Sources

There are various sources of capital small businesses can draw upon. There tend to be 4 general types of sources, in increasing order of interest rate cost:

- Owners contributing more capital or foregoing wages. This is nominally free, though there is an opportunity cost to ownership of investing more capital in the business.

- Bank line of credit or term loan including SBA-backed term loans. Interest rates are in the mid-single digits, though personal guarantees are required and sometimes liens on owners’ homes.

- Mezzanine lenders beyond traditional banks. Credit cards fall into this category, as do other non-bank lenders who are comfortable lending in higher risk situations with less collateral or security in exchange for higher interest rates in the 20% range.

- Online lenders such as Fundbox, Kabbage, and now QuickBooks Capital which connect to QuickBooks and use QB data, primarily accounts receivable data, to very quickly underwrite and advance loans. Interest rates range from 24% to 40% or more, so these should be a last resort.

Need Help with Cash Planning & Financial Modeling?

SmartBooks has worked with many clients to model different revenue scenarios and help determine options to adjust cost structure and/or utilize different credit facilities. Our senior team, including our CEO, COO, and Controllers are ready to help. To schedule a free 15 minute finance consultation, please click here to book time directly on our calendars.

Download the Guide

If you would like a PDF copy of this guide, simply fill out the form below.